Business leaders, particularly those involved in R&D and innovation, have much work to do to prepare for an imminent increase in workload, according to a study which shows that pressure from global governments will cause R&D activity to increase in the next three years.

According to new research from Ayming, a business consultancy that specialises in innovation, 68% of UK business leaders are satisfied with their current levels of R&D, suggesting there is a complacency which could result in businesses not being prepared for this upturn.

Mark Smith, Partner of Innovation Incentives at Ayming UK and Ireland said: “This level of satisfaction should give us pause for thought. In my view, there’s no such thing as ‘enough’ R&D. Governments appear to recognise this, but businesses will have to as well if our economies are to thrive and our societies progress as quickly as we hope.”

The Ayming report suggests that CFOs should consider how their business will react financially to this increase demand for innovation, and how they could finance such ventures, with three-quarters of business leaders anticipating a rise in R&D budgets, a third of whom expect this rise to be ‘significant’.

CFO 3.0

Many CFOs are now expected to play a key role in driving innovation. A recent Sage report found that a new generation of CFO is emerging, one that has seen the role expand. Financial Directors are now expected to drive strategy and take decisions that affect the whole organisation. In the Sage report, six in ten felt they were primarily responsible in driving digital transformation.

Sabby Gill, Managing Director UKI at Sage said: “CFOs are expected to be ‘visionaries’, using data to make intelligent decisions, in order to drive digital transformation in their organisation. For this to become a reality, it has to be easier for leaders to act upon data at speed. They need tools that will empower them to use their skills and experience in a much more compelling way

“While the burst of e-commerce and, in turn, digital transformation in business poses many opportunities, it is the very nature of e-commerce that is driving the top three challenges that financial decision-makers face – managing risk such as fraud and cybersecurity, compliance and legislation changes and adapting to changing role requirements.”

As Gill suggests, the responsibility of driving R&D and innovation, and to be visionaries, could fall on many CFO’s shoulders. R&D does not just happen by accident, however, and careful planning, particularly financial, is required to ensure that this innovation happens. Once a path to innovation is determined, securing funding and determining how this funding can be used most efficiently and for maximum impact is next.

Finance

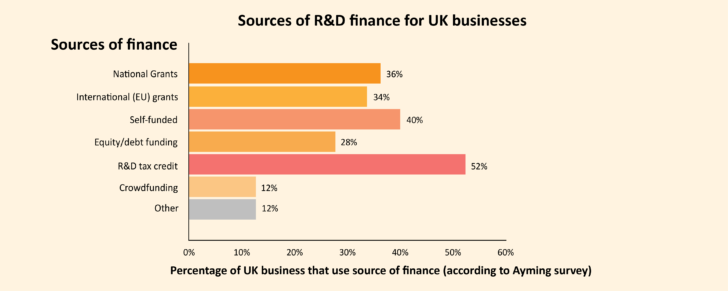

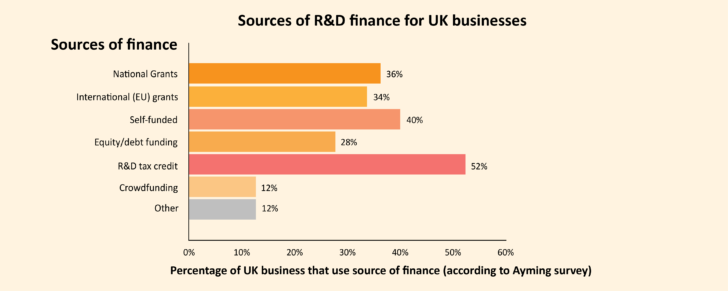

There are a number of different avenues for businesses to go down to secure funding for R&D. Grants, both national and from the EU are available. There is the option of equity debt funding, crowd funding and R&D tax credits. Businesses may also opt to fund R&D project with internal funds.

In the UK, the most popular source of R&D funding is through R&D tax credits, with 52% of organisations surveyed in Ayming’s report saying that this is what they use to fund projects. Self-funding projects was the second most popular, with 40%, and then national grants at 36%.

Grants and R&D credits are under-used resources for businesses looking to invest in R&D. Grants are designed to encourage specific behaviour, and often have ideological motive from governments or a funding body, to encourage investment in specific fields. In contrast, Tax credits are an easy-to-use financial instrument which businesses of all sizes can employ, without applying to a specific field of innovation that the government is pushing.

For more on R&D tax grants, listen to Accountancy Age’s podcast:

However, these options can be difficult and time-consuming to apply for successfully, and this acts as a deterrent, as can grants from the EU. An alternative option to secure funding, particularly for SMEs looking to drive innovation, is through alternative funding. While banks have become reluctant to lend to SMEs due to economic uncertainty, a host of options are available to businesses in the form of alternative finance.

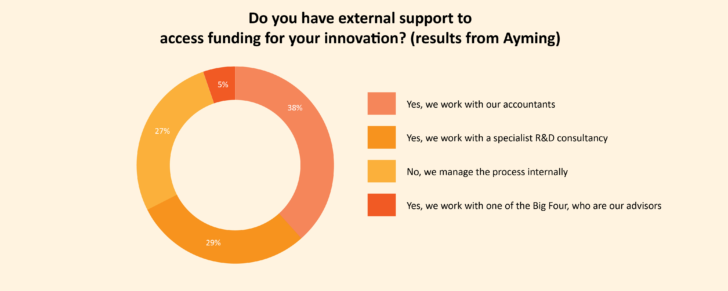

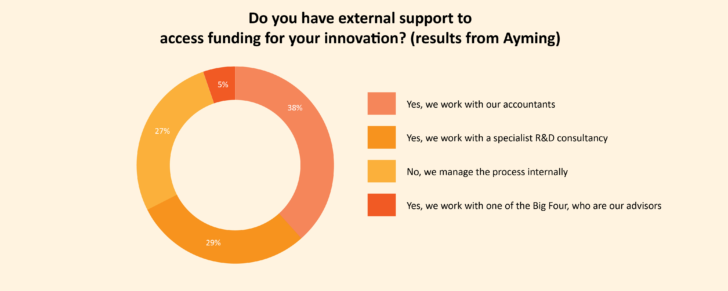

Three quarters of respondents to the Ayming report said that they have used external support when accessing funding. This could be a grant application of calculating tax credits, and this often comes down to education, with people not realising they are missing these opportunities. As demand for R&D has increased, many accounting firms have an R&D department.

The most common support respondents said they use when applying for funding is to use their accountants (39%), who are more likely to have this knowledge and expertise to recognise tax opportunities, and how to apply to such schemes. 29% said that they use specialist R&D consultancies. This willingness to use outside resources brings us to the next important factor when driving innovation – collaboration.

Collaboration

The Ayming report found that 63% of respondents said that they reply on internal resources when carrying out R&D. A key reason for this is that R&D is often secretive, and competitors are not inclined to share innovation in order to get ahead of other organisations in the market. Innovation collaboration can also have cultural and communication challenges attached.

However, when it comes to R&D and innovation, it can be in a business’ best interest to collaborate and share resources, knowledge and ideas. When innovating, this can be extremely valuable, particular when two organisations are working towards a shared goal.

Fabien Mathieu, Managing Director of Ayming in France says: “Innovation is a knowledge economy. It’s often very scientific so improving methodologies is key. It makes no sense for businesses to separately go through the same trial to come to the same conclusion. You wouldn’t waste time reinventing the wheel.”

Collaboration is particularly important for smaller companies who do not have as many departments covering different areas of expertise. Partnering with others will help fill this knowledge gap and ease the burden of innovation on each other while mutually benefiting in the long-term.

Talent

Talent is also vital to R&D. A business can inject all the funds in the world into a project, but without the correct talent in place, it will not work. 73% of respondents to the survey said that they expected talent to impact their organisation’s ability to undertake R&D, while two thirds expected new talent to have a positive impact.

However, this could also suggest complacency. There is an expected talent gap in the market, and with an upturn in R&D activities demand will be higher. Decision makers would be wise to plan their talent acquisitions in-line with financial planning.

Mark Smith, Partner of Innovation Incentives at Ayming UK and Ireland, said: “R&D success depends on talent. It’s a highly-skilled field, which is driven by people’s ideas. With competition over talent set to hot up over the coming years, businesses should take steps to prevent the pool drying up.

“One thing that would help is a greater focus on gender diversity. Yet at the moment, 46% of business leaders believe diversity to be unimportant, with 23% saying it is “not important at all”. We think this is a mistake. 83% of innovation teams are majority male, with a quarter of firms reporting that fewer than one-in-ten of their R&D employees are women. It’s clear there is an untapped pool of women that businesses should be looking at to succeed in new R&D projects.”

Was this article helpful?

YesNo